Product Description

Royalty Rates in Pharmaceutical and Biotechnology Deals 2010 to 2025

- Publication date: July 2025

- Page count: 500+

- Format: Viewing software (encrypted access), PDF (unencrypted access)

Essential Benchmark Data for Dealmakers - this report is your one-stop source for providing real-deal information on hundreds of transactions, including the technology licensed, royalty rates, license fees, upfront and milestone payments.

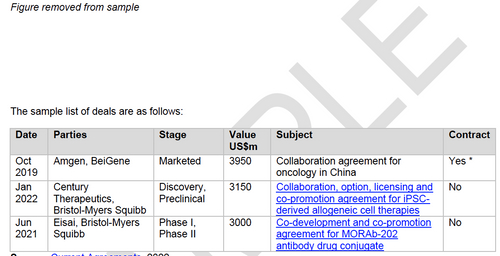

This report provides details of the latest partnering deals which disclose a royalty rate, announced in the pharmaceutical, biotechnology and diagnostic sectors. The report provides details of partnering deals disclosing royalty rates from 2010 to 2025.

The report provides an overview of how and why companies enter partnering deals where a royalty is payable upon commercialization of the compound or technology.

Understanding the flexibility of a prospective partner’s negotiated deals terms provides critical insight into the negotiation process in terms of what you can expect to achieve during the negotiation of terms. Whilst many smaller companies will be seeking details of the payments clauses, the devil is in the detail in terms of how payments are triggered – contract documents provide this insight where press releases and databases do not.

This report contains a comprehensive listing of all partnering deals announced since 2010 where a quantitative royalty rate has been disclosed, as recorded in the Current Agreements deals and alliances database. Each deal record and royalty disclosure is available in further detail via a link to online copy of the deal including actual contract document, where available, as submitted to the Securities Exchange Commission by companies and their partners.

The initial chapters of this report provide an orientation of royalty rate trends in pharma and biotech since 2010. Chapter 1 provides an introduction to the report, whilst chapter 2 provides an overview of the trends in royalty rates in the pharma and biotech sectors since 2010.

Chapter 3 provides a more detailed insight into the structure of a royalty rate clause and how it fits with the other financial terms of the partnering deal.

Chapter 4 provides an insight into companies active in disclosing royalty rates as well as those deals attracting the highest royalty rates.

Chapter 5 provides comprehensive and detailed access to deals which disclose a royalty rate since 2010 where a contract document is available. Contract documents provide an in-depth insight into the actual deal terms agreed between the parties with respect to the royalty rate.

In addition the report includes a comprehensive deal directory listing of all deals where a royalty rate has been disclosed announced since 2010. Each listing is organized as a directory by company A-Z, stage of development at signing, therapeutic area, and technology type. Each deal title links via hyperlink to an online version of the deal record including, where available, the actual contract document.

The report also includes numerous table and figures that illustrate the trends in royalty rates in pharma and biotech deal making since 2010.

In conclusion, this report provides everything a prospective dealmaker needs to know about royalty rates in the pharma and biotech sector.

Key benefits

Royalty Rates in Pharmaceutical and Biotechnology Deals provides the following benefits:

- Understand royalty rate trends since 2010

- Analysis of the structure of royalty clauses with real life case studies

- Browse collaboration and licensing deals which reveal a royalty rate

- Benchmark analysis – identify market value of transactions

- Financials terms - upfront, milestone, royalties

- Directory of deals by company A-Z, therapy focus and technology type

- Access contract documents - insights into deal structures

- Due diligence - assess suitability of your proposed deal terms for partner companies

- Save hundreds of hours of research time

Report scope

Royalty Rates in Pharmaceutical and Biotechnology Deals is intended to provide the reader with an in-depth understanding of the royalty rate trends and structure of deals entered into by leading life science companies worldwide.

Royalty Rates in Pharmaceutical and Biotechnology Deals includes:

- Trends in royalty rates in the biopharma industry since 2010

- Analysis of royalty rate clause structure

- Case studies of real-life licensing deals which disclose royalty rates

- Comprehensive listing of licensing deals which disclose royalty rates since 2010

- Access to licensing contract documents which disclose royalty rates

- The leading licensing deals by royalty rate value since 2010

- Most active royalty rate disclosures since 2010

In Royalty Rates in Pharmaceutical and Biotechnology Deals available deals and contracts are listed by:

- Company A-Z

- Headline value

- Therapeutic area

- Technology type

Each deal title links via Weblink to an online version of the actual deal record and where available, contract document, providing easy access to each contract document on demand.

The Royalty Rates in Pharmaceutical and Biotechnology Deals report provides comprehensive access to available contract documents for licensing deals.

Analyzing actual contract agreements allows assessment of the following:

- What are the precise royalty rates granted?

- What is actually granted by the agreement to the partner company?

- What exclusivity is granted?

- What is the payment structure for the deal?

- How are sales and payments audited?

- What is the deal term?

- How are the key terms of the agreement defined?

- How are IPRs handled and owned?

- Who is responsible for commercialization?

- Who is responsible for development, supply, and manufacture?

- How is confidentiality and publication managed?

- How are disputes to be resolved?

- Under what conditions can the deal be terminated?

- What happens when there is a change of ownership?

- What sublicensing and subcontracting provisions have been agreed?

- Which boilerplate clauses does the company insist upon?

- Which boilerplate clauses appear to differ from partner to partner or deal type to deal type?

- Which jurisdiction does the company insist upon for agreement law?